Always the Key Balance of Cryptocurrencies, Capitalization, Supply and Demand, and Digital Asset Governance

The cryptocurrency market has been on a wild ride over the past decade, with prices fluctuating wildly in response to a variety of factors. At its core, this market is driven by fundamental forces such as capitalization, supply and demand, and the inherent properties of digital assets such as cryptocurrencies. In this article, we delve into the intricacies of these concepts and examine how they impact the crypto market.

Capitalization: The Weight of Numbers

Capitalization refers to the market capitalization of a cryptocurrency, which is essentially its total value as represented on exchanges. A higher capitalization indicates greater demand and perceived value among investors. When a particular cryptocurrency’s market capitalization reaches a certain threshold (usually above $10 billion), it is often considered “tradable.”

For example, Bitcoin’s market capitalization reached an all-time high in 2021, reaching approximately $2 trillion. This level of capitalization has a significant impact on overall sentiment and market direction.

Supply and Demand: The Balance of Power

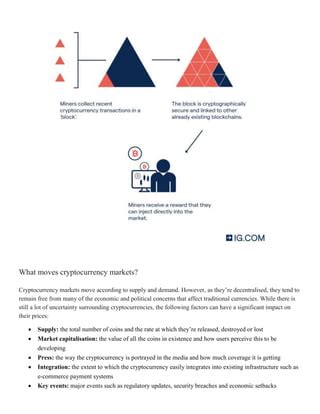

The fundamental forces of supply and demand play a key role in shaping the price movements of cryptocurrencies. The perceived value of a digital asset is determined by its relative scarcity or abundance, as well as the level of interest from potential buyers.

When there is an oversupply of a particular cryptocurrency (e.g. Ethereum), its value can be artificially depressed due to a glut in the market. Conversely, when there is a shortage or high demand for a digital asset (such as Bitcoin or Cardano), its price can skyrocket.

Digital Asset Management: The Art of Allocation

Digital assets are highly volatile and prone to significant price swings. To mitigate this risk, investors often employ a strategy known as “digital asset management.” This involves creating a diversified portfolio by allocating a portion of their investment capital to each digital asset.

A well-managed digital asset allocation can help minimize the impact of market downturns while maximizing returns during periods of growth. Some key principles include:

- Diversification: Spreading investments across different asset classes, such as cryptocurrencies and traditional stocks.

- Risk Management

: Setting clear investment goals and creating a risk management framework to mitigate potential losses.

- Asset Allocation: Allocating capital across different asset classes based on market conditions and investor preferences.

Key Takeaways:

- Capitalization:** A cryptocurrency’s market capitalization plays a significant role in determining its value and influence within the broader market.

- Supply and Demand:** The balance of supply and demand is critical in determining price movements in cryptocurrencies, with oversupply or undersupply affecting their value.

- Digital Asset Management: Creating a diversified portfolio through digital asset management can help investors mitigate market risks while maximizing returns.

Investment Strategies:

For those considering investing in the crypto market, here are some basic strategies to consider:

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals regardless of market performance.

- Long-Term Focus: Emphasizing long-term investment horizons over short-term price fluctuations.

- Research and Due Diligence: Thoroughly research each cryptocurrency before investing.

Conclusion:

The crypto market is characterized by complex relationships between capitalization, supply and demand, and the management of digital assets.