Here’s an article based on your request:

“Crypto Market Watch: Decoding Fundamental Valuation, Stop Orders, and P2P Trading Strategies”

The cryptocurrency market has been a highly volatile and rapidly evolving space in recent years. With the rise of cryptocurrency exchanges, decentralized finance (DeFi) protocols, and peer-to-peer trading platforms, investors have access to a wide range of investment options. However, navigating the complex cryptocurrency landscape can be daunting, even for the most seasoned traders.

In this article, we’ll look at three key strategies worth considering when evaluating the cryptocurrency market: fundamental valuation, stop orders, and peer-to-peer trading.

Fundamental Valuation

Fundamental valuation is a crucial aspect of investing in any asset class, including cryptocurrencies. It involves analyzing the underlying economics and fundamentals of an investment to determine its potential for growth and profitability.

When it comes to cryptocurrencies, fundamental valuation is particularly difficult due to the lack of traditional financial metrics such as earnings per share (EPS) or revenue growth. However, investors can still get a sense of a cryptocurrency’s underlying value by looking at factors such as:

- Supply and demand

: The total supply of a cryptocurrency, including its circulating supply and total market capitalization.

- Price-to-book ratio: The price of the cryptocurrency divided by its book value (its total assets minus its liabilities).

- Economic indicators: Economic indicators such as GDP growth rate, inflation rate, and unemployment rate.

For example, if we look at Bitcoin’s fundamental valuation, we can see that it has a low price-to-book ratio of around 25x. This suggests that investors are willing to pay 25 times the book value of Bitcoin to acquire it.

Stop Orders

Stop orders are a powerful technical trading strategy that allow traders to set a price level below which they will automatically sell an asset when it reaches or exceeds that level. The purpose of a stop order is to limit potential losses and protect against large price movements.

In the context of cryptocurrency investing, stop orders can be used in conjunction with fundamental analysis to create a comprehensive trading plan. For example:

- Entry Strategy: Buy Bitcoin at a low price when you see support levels or when you feel it has a good chance of breaking above a certain level.

- Stop Loss: Set a stop loss at a price below which the asset will be automatically sold, limiting potential losses if the market moves against you.

Peer-to-Peer Trading

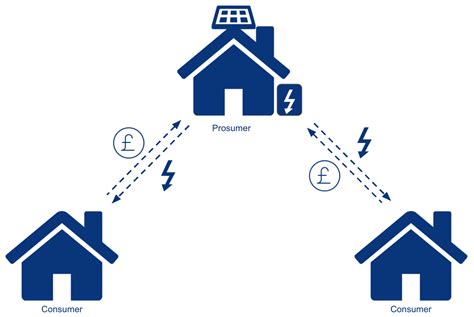

Peer-to-peer trading is the practice of buying and selling assets directly with other traders without the need for a centralized exchange or broker. This model allows investors to trade cryptocurrencies on their own terms, reducing transaction costs and increasing liquidity.

In the context of peer-to-peer trading, there are several popular platforms that allow individuals to buy and sell cryptocurrencies:

- Bittrex: A popular platform for buying and selling Bitcoin, Ethereum, and other altcoins.

- Poloniex: A leading cryptocurrency exchange that offers a wide range of trading pairs and features such as leveraged trading.

- Kraken: A reputable platform for buying and selling cryptocurrencies, offering advanced tools and features like position trading.

In conclusion, fundamental assessment is a key aspect of investing in the cryptocurrency market, while stop orders offer a powerful set of technical tools to limit losses and protect profits. Peer-to-peer trading gives investors direct access to the market, allowing them to trade on their own terms and benefit from lower transaction costs.