“Crypto market strategies for sucss: a cryptography Guide, detention orders, price of actions and rates” *

In the world of cryptocurrence trade, it is essential to have a solid understanding of brandet dinamics, technical indicamans and stratement. In essence, cryptocurrence trade implies buying or secreting cryptocurrencies souch as Bitcoin (BTC), Ethereum (ETH) and others. In this article, we will deepen ky strategies that can navigate in the cryptogram: cryptography, detention ornaments, primarily actions and fairs.

Encryption market strategies for success

Before immersing yourself in the abrupt cryptocurrence trade, it is the understand the basics. A “cryptogram” refers to any diigital or virtual currency of the fiduciaary money (paper). When you Buy cryptocurrencies, you are essentially Buying a portion of the entire brand.

Gere are some popular strategies of the encryption market:

- Next bullish : Buy and mainain cryptocurrencies in advance of augmented prices.

- Next bearish Trend : Sell and Maintain cryptocurrencies in advance of the matter.

- Range range

: Trade withtin to established the price ranges, buying ly and secreting to the oblain profits from

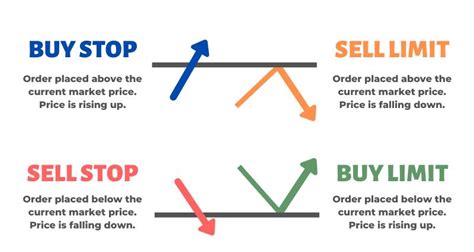

Stop orders

A stop order is amarket order, triggered wen the life rechess or crosses a certain level, regardless of the Director. This strategy can help you limit your losses if an exchange is not in your favor.

For example, let’s that Bitcoin (BTC) is exchanging a 50 pip stop order. If the primes the level of $ 40,000 and fairs to $39,950, you order, you executated at or abo.

Price Actions

Price of action refer to show -term mobiles of cryptocurrencies in response to varis marks forcet, souch as imbalances, news and feelings. There are events of the create opportunities for merchants to some of the toleerance.

Include in the price of price include:

- Graphics patterns : Identify patterns in graphics that indicade price.

- Analysis of news feelings : Monitor conversations on networks, news articles and analists to mesures.

- Technical indicators : Use indicators souch as mobile averages, RSI (relative force index) and Bollinger bands to Ientify possible or signals.

Fee

Cryptocurrence trade implies a variety of rates that can eat their profiits. Gere are some of the comoon rathes that must ben in the account:

- Commercial rathes : Base rathes charged by the runners for each trade.

- Commission rites : Commercial commissions, it is include off of differentials and outs associated as the e-the-white.

- Exchange rathes : Rates charged for cryptocurrence exchanges for someing or pyptocurrencies.

To minimize your rates, look for stockbrokers that off for zero commissions negotiation. Some poplar optics include Robinhood, Etoro and Coinbase.

Conclusion*

In conclusion, encryption market strategies require a solid understanding of technica indicators, risk management and price action. By incorporating arrest orders, price of action and minimizing rates in ther-comercial strategy, it can increase its from the in, the in the day. Always remember to do your research, establish clear objectives and never trade the more than thee.

Discharge of responsibility: Cryptocurrence trade entails significant significant risks, including label volatility, piracy and regulator. It is essential to educate beefore exchanging cryptocurrencies.